Going to college is an exciting time in your life. But when you dip your toes in the water of adulthood, you’ve got to be able to sink or swim financially. Whether you’re a high school senior preparing for the leap, or a current college student seeking savvy strategies, mastering money management is key to your success. The truth is: financial planning for bachelor’s degree students should be a top priority.

For any parents wondering how to prepare their college-bound kids for financial stability — imagine if you had a guide like this when you first stepped onto campus. I certainly wish I did.

Twenty-five years ago, as a first-generation college student, I faced a lot financial challenges. Figuring out how to finance my education was scary, to say the least. Back then, resources and guidance were scarce. I often found myself grappling with the uncertainties of budgeting, managing student loans, and securing financial aid.

When I look back on those years, I remember how important it is for students to have the knowledge and tools they need to thrive in today’s college. That means being able to focus on your studies without constantly worrying about money. I understand firsthand the difference that practical advice and support can make in shaping the trajectory of one’s educational journey. With these insights on financial planning for bachelor’s degree students, I aim to empower you to navigate the financial aspects of college life with confidence and clarity.

Related Resources:

Working While Studying: Balancing Part-Time Jobs with Bachelor’s Programs

Scholarships For Bachelor’s Programs: An Easy Guide for Students

First published in March 2024. All data was accurate at time of publication. Bachelor’s Degree Center articles are for information purposes only and are not professional financial advice.

Budgeting Tips for College Students

College is an amazing time, but money worries can hold you back from having the best experience. This guide on n financial planning for bachelor’s degree students will show you how to be a college cash whiz! We’ll cover how to track your spending so you know where your money goes. Then, we’ll walk you through creating a budget to make sure you have enough for everything you need. There are even cool apps that can help you manage your money! Finally, we’ll share some tips for saving money, because every dollar counts in college. By following these steps, you’ll be a money master and can focus on enjoying all that college has to offer!

Track Your Spending:

College can be expensive! Keep a list of everything you spend money on, like books, food, getting around, and fun stuff. This will help you see where your money goes. When I was in college, I didn’t track my spending, and I often ran out of cash by the end of the month!

Budgeting is Key:

Make a monthly budget based on your income (job, allowance, scholarships). Include essentials like tuition, rent, and groceries. Leave room for savings and some fun money too! This helps you avoid stress and pay for everything without needing too many loans or credit cards.

Budgeting Apps Help:

There are apps like Mint or PocketGuard that can help you track spending, set goals, and even give you tips! These weren’t around when I went to college, but they’re super helpful for students today. They show you your finances in real-time.

Be Frugal!

Save money by buying used books, cooking at home, and using student discounts. Every little bit counts! As a first-generation college student, I learned to stretch every dollar. Being frugal helped me make the most of my money and stay on track financially.

Managing Student Loans Responsibly

Don’t be afraid of student loans. Just be smart. Student loans can help you pay for college, but it’s important to be smart about them. Here’s how:

- Exhaust free money first: Apply for scholarships, grants, and work-study programs before taking out loans. This will minimize your debt burden.

- Federal loans are best: If you do need loans, choose federal loans. They typically have lower interest rates and better repayment options. I didn’t know this when I was in college, and I relied heavily on loans I didn’t fully understand. Borrow wisely!

- Know your loan terms: Understand things like repayment plans, grace periods, and deferment options before you borrow. Ask questions if anything is unclear! Not knowing this stuff can cost you money later.

- Pay on time, every time: Make your loan payments on time to avoid late fees and hurting your credit score. You can even set up automatic payments for peace of mind. Like me, you might feel overwhelmed by loans after graduation. Making on-time payments is key to building good credit and saving money.

- Get help if you need it: There are plans to help you repay loans if you’re struggling. Talk to your loan servicer or financial aid office if you need assistance. You don’t have to go through this alone!

Finding Financial Aid Resources

College can be expensive, but being financially smart isn’t just about tightening your belt! There’s a ton of “free money” out there in the form of scholarships and grants that can seriously lighten your financial load. Understanding financial aid is a huge help when it comes to financial planning for bachelor’s degree students.

- Scholarship Hunt: Look for scholarships from your school, local groups, and online databases. Scholarships are basically free money that can save you big on college costs. When I was in college, coming from a poor family, the only way I was able to make it was by applying to every scholarship I could. But back then, I had to ask around and really research. The information wasn’t all online. You kids have it easy! Don’t miss out – actively search for them!

- Fill Out the FAFSA: The FAFSA is your key to federal grants, loans, and work-study programs. Fill it out carefully and on time to get the most aid you qualify for. The FAFSA can unlock financial help you might not have known about. Use this free money to pay for your education!

- Ask Your School’s Financial Aid Office: They can help you apply for aid, understand your award letter, and find other funding options. As a first-generation student, financial aid was confusing, and I was often embarrassed to admit I didn’t know what I was doing and ask for help. But there are lots of wonderful people working in every college financial aid office. They’re there to help you! Don’t be shy – ask the experts!

- Look Beyond Your School: There are scholarships from private companies, job programs that pay for college, and even community grants. Don’t limit yourself to what your school offers. Explore all your options to get the most money possible!

Mastering money management is a vital skill that will serve you well beyond your college years. By implementing budgeting tips, managing student loans responsibly, and tapping into financial aid resources, you can pave the way for a financially secure academic journey.

Remember, every smart money move you make contributes to your long-term success and financial well-being. Start building your financial foundation today and embark on your path to a brighter future.

As a first-generation college student, I understand the challenges you may face, but I also know the transformative power of education. With the right financial strategies in place, you can overcome obstacles and achieve your academic and career goals.

FAQs

College students manage money by:

• Tracking spending: Knowing where their money goes (food, books, fun).

• Creating a budget: Setting aside money for needs (rent, tuition) and wants.

• Finding free money: Looking for scholarships and grants to cover costs.

• Borrowing wisely: Only taking out loans they absolutely need.

• Working part-time: Earning money to help pay for expenses.

• Being frugal: Saving money by cooking at home, buying used books, etc.

By following these tips, college students can manage their money well and avoid debt!

Some studies say around 1 in 3 college students have less than $1,000 saved up.

It’s tough to say exactly how much money the average college student has in their bank account. There’s a big range depending on things like:

• Scholarships and grants: Some students have financial aid that helps cover costs, leaving them with more spending money.

• Jobs: Students who work part-time will naturally have more money coming in.

• Living situation: Living at home vs. on campus can affect expenses.

• Spending habits: Some students are more frugal than others.

Because of these differences, the average might not be very helpful.

Here’s a rough idea:

• Low: $200/month might cover basic needs for frugal students living at home.

• Average: $400/month is common for students who eat out sometimes and participate in some activities.

• High: $600+/month or more might be needed for students living on campus or in expensive cities with active social lives.

The key is to track your spending and create a budget that works for you! Aim to spend less than you earn and avoid going into debt for everyday expenses.

There’s no one-size-fits-all answer for how much spending money a college student needs. It depends on a few things:

• Your budget: How much money do you have coming in each month (from allowances, jobs, scholarships)?

• Your expenses: How much do you spend on essentials like rent, food, and textbooks?

• Your lifestyle: Do you like to eat out a lot or go to movies?

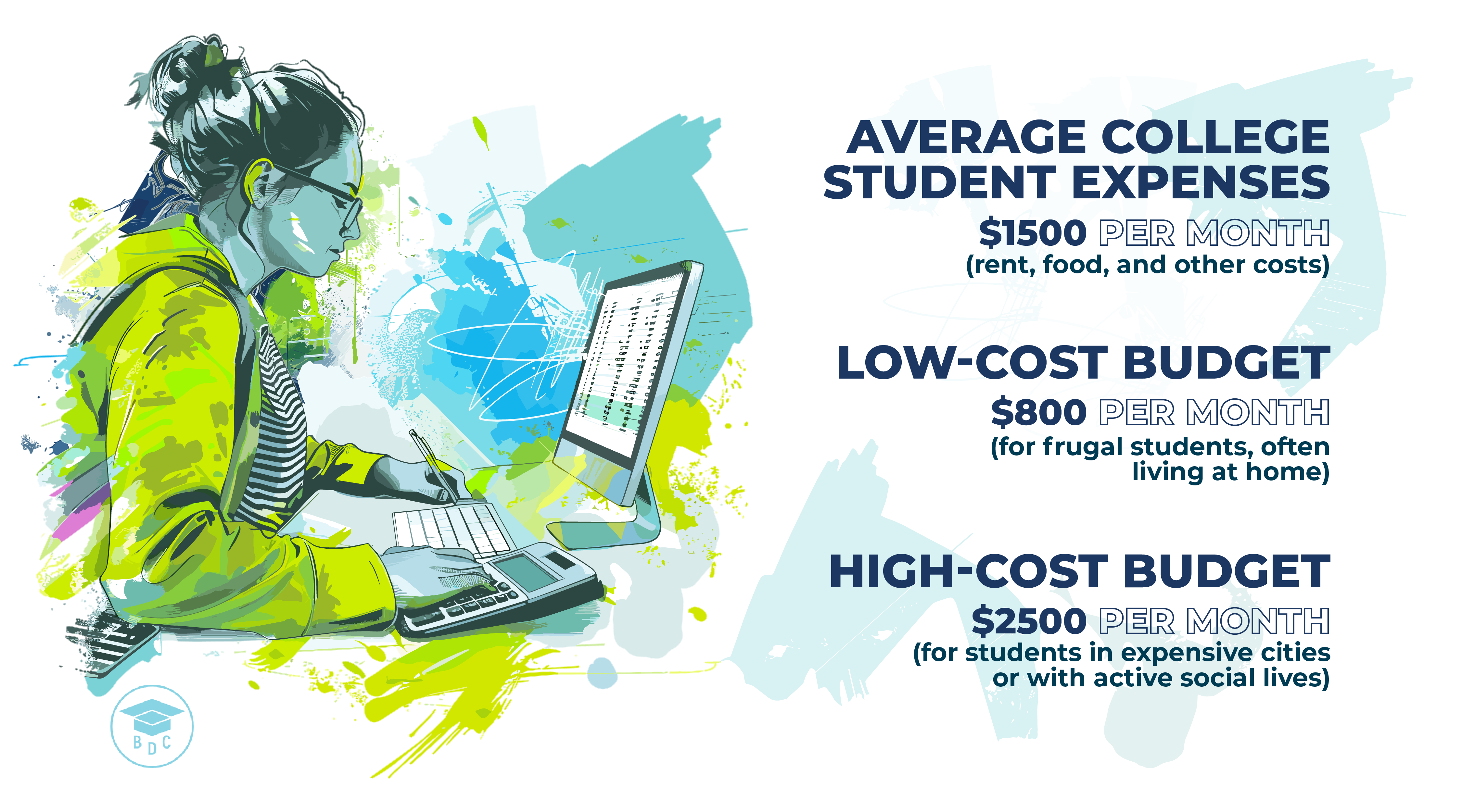

Here are some estimates to help you get started (based on U.S. studies):

• Average college student expenses: $1,500 per month (including rent, food, and other costs)

• Low-cost budget: $800 per month (for frugal students, often living at home)

• High-cost budget: $2,500+ per month (for students in expensive cities or with active social lives)

Remember, these are just estimates. The best way to create a good budget is to track your own spending and see where your money goes.

By creating a budget and sticking to it, you can manage your money well in college and avoid debt!

Yes, you can live off student loans. Lots of college students have done it for decades. But is it a good idea? No. That’s why the average federal student loan debt is $37,088. That’s also why so many people have been calling for student debt relief.

You can technically live off student loans, but it’s generally not recommended. Here’s why:

• Debt burden: Student loans can add up quickly, leaving you with a lot of money to repay after graduation. This can make it hard to afford other things you need, like rent, car payments, or starting a family.

• Stressful repayments: Large loans can lead to high monthly payments. If you don’t have a good-paying job after graduation, keeping up with payments can be stressful.

• Limited options: Relying solely on loans might not cover all your expenses. You might have to cut back on things you enjoy or struggle to afford unexpected costs.

Some situations might make student loans necessary:

• High costs: If your college is very expensive and you don’t have scholarships or grants, loans might help bridge the gap.

• Living expenses: Loans can cover rent, food, and other living costs if you don’t have other options.

Here’s the key: If you do take out loans, only borrow what you absolutely need. Be sure you understand the repayment terms and interest rates before you sign anything.

Alternatives to living off loans:

• Scholarships and grants: Free money to help pay for college.

• Work-study programs: Earn money while you learn.

• Part-time job: Earn extra income to cover expenses.

• Living at home: Saves money on rent and food.

• Budgeting wisely: Track your spending and find ways to save.

By exploring these options, you can minimize your reliance on student loans and avoid a heavy debt burden after graduation.