If you like to think about numbers or find the financial markets and investment vehicles such as bonds and stocks intriguing, you might want to consider majoring in finance. A finance major is a professionally-oriented move. Majoring in the art and science of managing money, as finance is commonly defined, presents you with an opportunity to learn about financial markets, various business models, and build new skills at the same time. You can pursue a bachelor’s in finance degree online or a traditional on-campus finance program depending on which option works best for you. It’s a perfect preparation for a master’s degree as well,

A finance major may be the right option for you if you are a working professional looking to access more opportunities or change careers, or a high school student choosing an undergraduate degree. But, what is a finance major, and what can you do with a degree in finance? Well, a lot. Career-wise, there are so many opportunities for finance majors. Some of the most common fields for finance majors are risk management, corporate finance, investment management, management consulting, investment banking, and more. As you can see, there are a lot of career options for finance majors out there.

What do finance majors do? With a finance major, you will learn all the various aspects of limiting or analyzing expenses, how to make key investment decisions, and financial planning. As an employee, you will be helping the company plan on how to maintain profitability or grow revenue both in the long term and the short term. You will be using numbers-driven approaches to solving problems in creative ways. With a bachelor’s degree in finance, you can become a personal financial adviser, financial manager, financial analyst, financial examiner, etc. A finance degree salary out of college can be quite rewarding, too. The choice is yours.

Related:

- Best Bachelor’s in Finance Degree Programs

- Best Online Finance Degree Programs

- Most Affordable Online Finance Degree Programs

- Fastest Online Finance Degree Programs

What Can I Do with a Finance Degree?

Are you wondering what to do with a finance degree? What do finance majors do? Finance majors have a lot of career opportunities for finance majors to pursue in a multitude of financial services industries after they earn their degree. But before that, you have to choose a college/university where you can earn a bachelor’s degree in finance, which can be an overwhelming process. There are plenty of factors to consider with accreditation being of utmost importance. After choosing a college, carefully consider the type of finance degree you want to pursue (as there are multiple options) and whether you want to earn your degree online, on-campus, or some sort of a combination of both.

What can you do with a finance degree? A bachelor’s degree in finance will open the door to diverse career paths and a variety of opportunities. But earning a bachelor’s degree in finance alone will not be enough to secure employment – you will need to get various certifications to increase the chances of securing a high finance degree salary out of college. There are several finance professional certifications to consider (to be discussed in detail later in the article). So if you want to know ”What can I do with a degree in finance?” learn more about what to expect as a finance major, including employability, entry-level career opportunities, and salary.

Business School Accreditation

Regional or national accreditation is intended to assure the student that a college or university adheres to the highest standards of quality based on professional practice and latest research. Whether it’s a traditional degree or a finance degree online, an institution of higher learning is expected to continue demonstrating growth and development. It shouldn’t just maintain existing standards but continually improve through regular review cycles after getting accreditation. Students, educators, and employers worldwide recognize accreditation as a symbol of excellence in the education sector.

This voluntary, non-governmental validation process is used to evaluate institutions of higher learning such as universities and colleges. Accreditation is used to test the effectiveness of an institution’s academic programs. The best undergraduate schools for finance majors have accreditation from various regional and national accreditation bodies. There are many types of business school accreditation, so don’t be confused if you notice that your college or university of choice is accredited by multiple organizations. Common business school accreditation bodies include:

ACBSP Accreditation

Established in 1992, the Accreditation Council for Business Schools and Programs (ACBSP) is one of the most recognized business school accreditation bodies in the world. Their goal is to reward excellence in education. The ACBSP embraces a more international collection of institutions of higher learning and is headquartered in both Belgium and the United States. This organization was the first to offer business accreditation at associate, baccalaureate, master, and doctoral degree levels.

ACBSP accreditation focuses on teaching excellence and student outcomes. The ACBSP gives accreditation for business-related and accounting programs and is recognized by the Council for Higher Education Accreditation (CHEA). The accreditation body recognizes the significance of scholarly research and encourages a balance between teaching and research. ACBSP accredited schools are some of the highest-ranked in the world. There are ACBSP accredited online schools too for those wishing to pursue their finance degree online.

AACSB Accreditation

Organized in 1916, the Association to Advance Collegiate Schools of Business (AACSB) is an internationally recognized business school accreditation body. AACSB members offer accounting and business at all levels. AACSB represents only the highest standards of achievement vis-à-vis business schools in the world, meaning that their accreditation is unsurpassed. AACSB accreditation is one of the most difficult to acquire for business schools across the world. Only less than 5% of the over 13,000 business schools applying to be accredited by the AACSB have the accreditation.

Business schools applying for AACSB accreditation are put through a rigorous process of peer reviews and self-evaluation. The process starts with the school submitting an application and waiting for the organization to approve the approval, after which the body’s requirements are evaluated and if the standards are met, accreditation is granted. Universities and colleges with AACSB accreditation have outstanding, unrivaled career opportunities for finance majors and include the best of everything. Choose one of the many AACSB accredited online schools when looking for an online bachelors in finance degree program.

ACBSP and AACSB are the most recognized business school accreditation bodies; the best undergraduate schools for finance majors will usually be accredited by one or the other. The difference between the ACBSP and the AACSB is that the former focuses on the quality of the faculty and those of who are teaching the business courses (not so much research) while the latter focuses on research and the institution’s commitment for the use of high-level research to deliver high-quality education. Another notable business school accreditation body is the International Assembly for Collegiate Business Education (IACBE). IACBE accredits universities and colleges that only offer associate degree programs in business and was founded in 1997.

Types of Finance Degrees

Students looking to work with investments and budgets for a company or for individual clients can pursue a finance degree. As stated earlier in the article, there are many types of finance degrees. What does a degree in finance do? If you find the stock markets interesting and you’d like to make investment predictions, have strict attention to detail, or enjoy solving problems, you can major in finance. But why major in finance and not in other similar options such as accounting? What is a finance major anyway? What do you learn with a finance degree? Keep reading to learn more about finance degrees.

Typically, a finance major is offered as a bachelor’s degree in finance. A finance major can also be offered as a specialization within a business administration program. Majoring in finance prepares you to work in this lucrative field. When it comes to giving students a high earning potential and great employment prospects, the best finance degrees are a solid preparation. Those with a finance major qualify for a vast range of opportunities in public and private organizations as well as non-profits.

Bachelor of Business Administration (Finance Concentration) or Bachelor of Finance

What are the common types of finance degrees? There are several ways to major in finance, and earning a Bachelor of Business Administration (BBA) with a finance concentration or Bachelor of Finance degree is one of them. Finance degree courses will be roughly the same in either, but a BBA will have more of a managerial emphasis, while the Bachelor of Finance will focus more on the numbers.

Students preparing for employment opportunities in entry-level finance jobs immediately after graduating as well as those looking for a career change by moving to the financial sector should pursue a bachelor of finance degree; it’s the best option for them. A bachelor’s degree in finance helps students develop skills and competencies required in today’s complex business world. The finance degree courses in a Bachelor of Finance will be rigorous and technical, so be ready for math and statistics.

What is a finance major, and what do you learn in the program? The best finance degrees help students understand the inner workings of complex financial systems, master analysis and investment practices, and gain knowledge of financial management tools. The finance degree courses in a BBA in Finance or Bachelor of Finance help students build foundational skills essential in the financial sector. You can earn a BBA in Finance or Bachelor of Finance online or on-campus, depending on your circumstances. If you’re a working professional with other commitments, you will find earning a finance degree online to be the more convenient option.

Associate Degree in Finance

Earning an associate degree in finance or business administration is a great option for those looking for an opportunity to major in finance. This type of finance degree program includes several introductory courses in financial management. Common finance degree courses in the associate finance degree program are Principles of Accounting, Microeconomics, and Macroeconomics. The best finance degrees at the associate’s level can be a great introduction to fundamentals knowledge and skills necessary for entry-level employment opportunities in the financial sector. Note that only a handful of institutions offer associate degrees in finance.

Finance Degree Requirements: What Do Finance Majors Do in Class?

Students looking to enroll for a bachelor’s degree in finance need to make sure that they’ve met all the requirements. In most cases, finance degree requirements at the undergraduate level include a strong college preparatory high school education. Subjects such as accounting, math, communication, speech, and English are vital. Finance is a field heavy on mathematics and statistics, so the best undergraduate schools for finance majors will expect a strong background in math. Finance degree courses will put a real emphasis on numbers, obviously.

The best undergraduate schools for finance majors will also put an emphasis on technology; computing power drives modern finance. Computer skills are important for qualification for the best finance degrees in the country. Therefore, students hoping to major in finance should enroll for computer technology classes in high school if available. Finance degree courses in the technology used for finance will expect a strong foundation in computer usage, but not necessarily programming. College admissions are big on leadership skills, students can volunteer in community programs or join various clubs that cultivate such.

Finance Professional Certifications

A lot of career opportunities for finance majors involve the practice of allocating monetary resources and making financial decisions. Even the best finance degrees may not be enough to distinguish yourself. So beyond the degree itself, what do finance majors do to prove they can handle the job? Those looking for career opportunities in the financial sector can seek certification at the graduate and baccalaureate level.

Accounting and finance certifications arm the student with the knowledge and background required to build a career in different fields of finance. There are many types of finance certifications depending on your career choice. Note that students can earn corporate finance certifications online by enrolling for online courses. Some of the best finance certifications include:

Financial Risk Manager (FRM) Certification

Finance majors pursuing careers in risk management positions such as risk analysts and risk officers can improve their chances of securing employment by getting Financial Risk Manager (FRM) Certification. FRM is a niche and a targeted certification for those looking for specific careers in risk management. The pass rate for FRM certification is roughly 50 percent and takes about a year to complete.

Certified Financial Planner (CFP) Certification

Those looking at careers in wealth and investment management stand to reap a lot of benefits from earning a Certified Financial Planner (CFP) Certification. This is one of the best finance certifications. CFP focuses on high net worth or retail segment of investment management, financial planning. CFP certification is a good differentiator and offers great value for wealth management, private banking, and retail banking.

Chartered Alternative Investment Analyst (CAIA) Designation

The Chartered Alternative Investment Analyst (CAIA) designation is a great option for those looking at various career paths in niche areas of finance such as hedge fund and asset management. The pass rate for CAIA is about 70%. CAIA is a top finance certification covering topics such as risk management, asset allocation, structured products, real assets, private equity, hedge funds, and ethics. On average, CAIA takes about 12–18 months to complete.

Certified Public Accountant (CPA) Certification

When it comes to accounting and finance certifications, the Certified Public Accountant (CPA) Certification is one of the most popular options. A CPA certification plays really well in a finance career path and is the gold standard in the accounting world. CPA’s focus on corporate finance is minor but those who’d want to have a CFO’s job at some point in their career should consider getting a CPA certification.

Chartered Financial Analyst (CFA) Certification

Chartered Financial Analyst (CFA) certification is considered one of the best finance certifications in the world. CFA mainly focuses on investment analysis and portfolio management. The CFA certification has 3 levels, which take about four years to complete. The completion of this certification demonstrates a solid work ethic and a high level of intelligence – one of the best ways for recruiters to pick out the best employees.

Chartered Investment Counsellor (CIC) Certification

A Chartered Investment Counsellor (CIC) Certification is designed for those working in investment counseling and portfolio management. This designation is seen as a subset of the Chartered Financial Analyst (CFA) certification but is more specific. One needs to have at least five years of experience working at an Investment Adviser Association member to be eligible for a CIC certification.

So are accounting and finance certifications necessary? No, but they definitely have a benefit in giving a new graduate or young professional more authority. What does a degree in finance do without a certification? It still helps you get a job in finance, but everyone can use a little help.

Careers in Finance: What Jobs Can You Get with a Finance Degree?

Once they have the degree and certifications, what do finance majors do to find jobs? What can you do with a degree in finance? There are numerous careers with a finance major’s degree in the financial sector and other industries, especially with the best finance degrees. Finance major careers require individuals who can evaluate the qualitative and quantitative dimensions of an entity’s problems and assess the financial implications of individual and corporate actions. These professionals have the analytical skills to appraise the financial standing of a business by dissecting its financial statements.

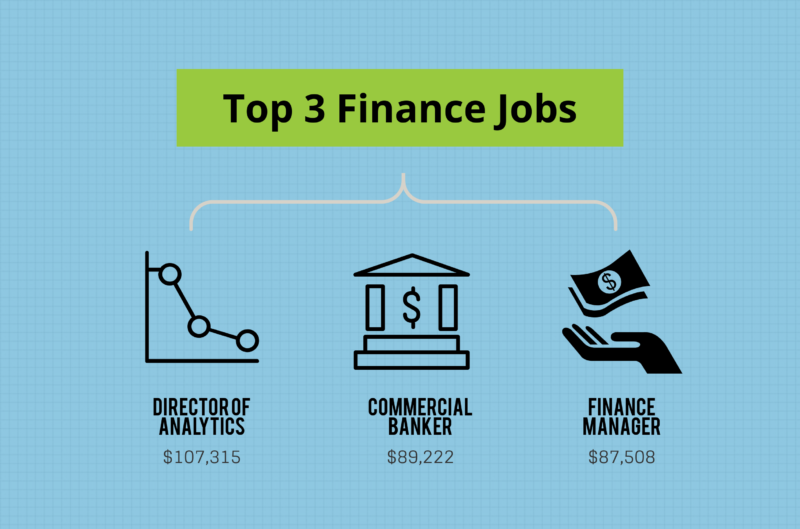

What do you do with a finance degree? The most popular jobs for finance majors are in fields such as risk management, corporate finance, investment management, management consulting, real estate, commercial banking, insurance companies, and investment banking – only to name a few. These are where you’ll see the best finance degree salary out of college. You won’t be a chief financial officer, but entry-level positions in financial analysis are high-paying. The most common types of finance jobs include:

Budget Analysts

Finance majors have the analytical and communication skills needed to become budget analysts. A budget analyst analyses budgets and evaluates the financial impacts of existing and new ventures. A budget analyst applies the principles of finance to proposals and projects in governmental, educational, business, and non-profit sectors and offers advice on whether to proceed or not. The budget analyst is one of the most popular entry-level finance degree jobs for finance majors. Since these professionals have to interview different people within the organization, communication skills are a must-have.

Financial Analyst

Finance majors can choose to become financial analysts. A financial analyst helps individuals or businesses make smart investment decisions. The duties of a financial analyst may include advising management and clients on when to buy and sell, assessing the performance of various bonds and stocks over time, and maintaining investment portfolios. A financial analyst can work within a particular organization or in an investment firm. To work as a financial analyst, you need to be licensed by the Financial Industry Regulatory Authority. The Chartered Financial Analyst (CFA) designation is recommended.

Financial Examiner

Banks and other financial institutions are regulated by the federal government. The government, through regulation, protects borrowers from unfair loan practices such as predatory lending. Financial examiners are employed by the federal government to ensure that banks and other financial institutions comply with all the finance laws and regulations set by the federal government. Finance majors have the knowledge and skills required to take up careers as financial examiners. A financial examiner position is one of the best entry-level jobs for finance majors – no certifications are required.

Financial Manager

Finance majors can develop the skills required to become financial managers. A financial manager is tasked with the role of minimizing risk and maximizing profit by monitoring an organization’s financial health and activities. Financial managers generate financial statements and provide guidance to business leaders in financial planning and direct the wealth of the company. Financial managers also go with other job titles such as cash managers or credit managers. Designations such as Chartered Financial Analyst (CFA) and Certified Treasury Professional (CTP) are recommended for those looking at financial management as a career path.

Personal Financial Advisor

Personal financial advisors are very similar to financial analysts. Both professionals help their clients with long-term investments and financial planning. The key difference between the two is that while financial analysts work with large businesses, personal financial advisors work with individual clients, one-on-one. The duties of a personal advisor go beyond the investment portfolio, they help the client plan for retirement, pay for college, buy a house, and plan for other major events. Those looking a finance career path as personal financial advisors can enhance their career and reputation with a Certified Financial Planner (CFP) certification.

A finance degree can also set you up for careers like loan officer, actuary, stockbroker, underwriting, and more.

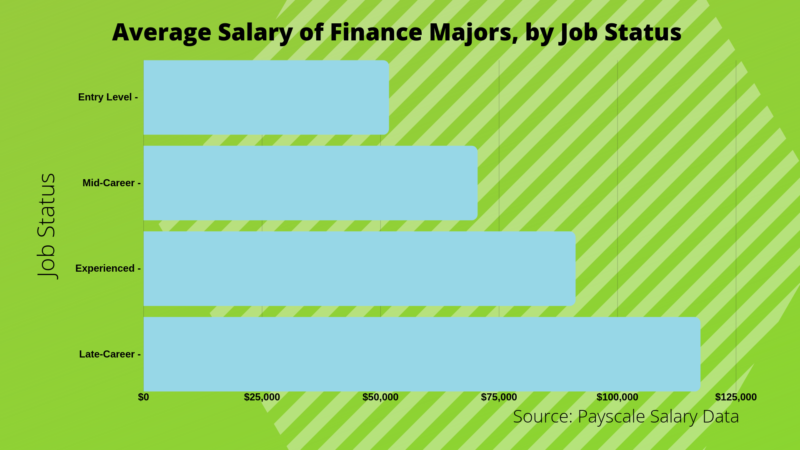

Making Money: Finance Degree Salary Out of College

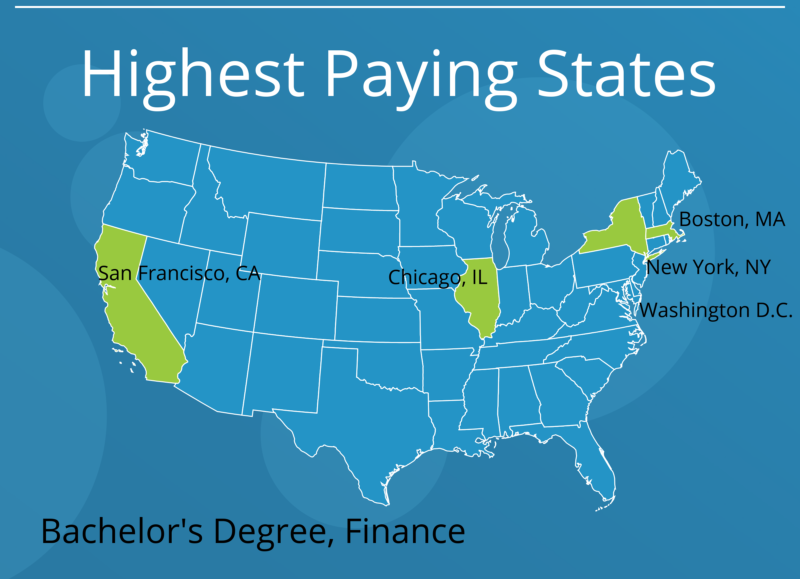

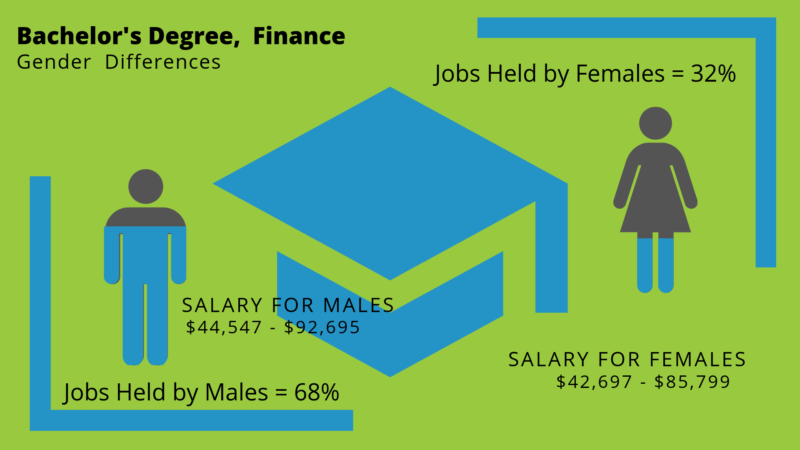

What can a degree in finance get you for a salary? A lot of factors affect a finance major salary. A finance degree salary, for instance, is greatly influenced by prior experience, so finance degree salary out of college will be a lot less than the pay of someone with 10 years of experience. Graduates with years of experience are more likely to earn more than fresh graduates. A finance major salary is also affected by the finance career path the student chooses. Some finance career paths tend to have a higher salary than others. What is the average salary in finance? According to the PayScale College Salary Report 2017–18, the average finance degree salary out of college $57,500. Keep in mind that this finance major salary is for graduates who’ve just left college.

The bachelors in finance salary rises to $97,100 once the graduates have accumulated several years of experience in the field. A finance major gives the student a high earning potential as well as great graduate job prospects. Majoring in finance opens doors to a wide range of career opportunities for finance majors across multiple industries. Before choosing a final career path, take into consideration your unique combination of personality traits, values, interests, and skills. This will help you get the best out of your finance major, including your finance major salary.

Finance Professional Organizations

Despite the high number of career opportunities for finance majors, getting a job in finance is not as easy as you might think. The number of students majoring in finance is increasing, which means more competition for job seekers. Joining one of the many finance professional organizations is one of the best ways to gain a competitive edge. Finance professional organizations are non-profits whose mission is to serve the finance industry and the interests of professionals in the financial sector. Joining a finance professional organization presents an opportunity to learn, interact with professionals in the field, and stay on top of the latest trends in the industry.

Some of the most popular finance professional organizations include:

- American Finance Association (AFA)

- Association for Finance Professionals (AFP)

- Entrepreneur’s Organization (EO)

- International Federation of Accountants (IFAC)

- Professional Accounting Society of America (PASA)

Joining a finance professional organization is easy – all you need to do is apply and pay the annual membership fee. And the added authority can help make the most of your degree for a finance major salary. Find an organization that matches geographic location, level of experience, and industry specialization and become a member. Depending on the organization, re-certification and specialized training may be required to join.