Key Information:

- Actuarial science graduates can work in various sectors, including insurance, finance, and consulting, where they analyze risks and probabilities.

- To become an actuary, you will need to pass a series of exams which are rigorous and require a strong understanding of mathematics and statistics.

- The demand for actuaries is expected to grow as industries become more data-driven and complex, highlighting the importance of risk assessment skills.

If you’re considering a career in actuarial science, then you’re looking at an exciting career path. Actuaries get to examine a lot of scenarios, and they make a lot of money doing it. For those who enjoy math and statistics, there is no career option quite like becoming an actuary.

But what is actuarial science about? And what does an actuarial scientist do, specifically? Is actuarial science a good major for you? Actuarial science an important line of work, and not everyone is equipped to do it. It takes a lot of hard work, dedication, and willingness to get back up after failing.

If you want information about actuarial science because you’re considering it as a career, then you probably have a unique set of passions and talents, and you want to put them to good use. An actuarial career will absolutely help you do that.

What is Actuarial Science?

Now, the answer to the “What is an actuarial scientist?” question isn’t always as straightforward as people might like it to be. Neither is the “What is actuarial science about?” question, unfortunately. The truth is that information about actuarial science can get confusing. That’s because actuarial science is essentially several professions in one. Actuaries are basically statisticians, economists, accountants, and insurance experts all at the same time. Of course, for a lot of people, that’s exactly what makes the career so exciting.

So, what does an actuarial scientist do? The easy answer is that they work for insurance companies. If you become an actuary and someone at a party asks you “What is an actuarial scientist, exactly?” It may be easiest to stick with that answer. You might have a smoother conversation that way, since it can be tough to explain actuarial science over finger foods.

On the other hand, if the person seems really interested in the details, you might tell them more about your work and what it entails.

Insurance companies employ actuarial scientists to look at statistics and probabilities. Actuaries do the math to determine the likelihood of different scenarios, and then they figure out an insurance company’s financial risks in light of these scenarios. For example, an actuary can figure out the likelihood of a tornado hitting a specific area, or they can determine the mortality rates for specific demographics. This way, insurance companies can be prepared to make payouts when necessary. They can also gain the information they’ll need to price their products accurately.

So, now that you’ve asked “What does an actuarial scientist do?” is actuarial science a good major for you? Well, do you enjoy the idea of working for an insurance company? Do you enjoy numbers and statistics? Would you like a job that lets you do complex math on a daily basis? And can you handle the idea of taking several exams before you get certified? If so, then actuarial science may be a great major for you. Ready to learn more about your options? Then take a look below. The next several sections will cover actuarial topics, including:

- What is actuarial science about?

- How does a person become an actuary?

- What are some actuary career options?

- What kind of salary does an actuary make?

Actuarial science is a complex topic. The paragraphs below can help you find answers to your questions.

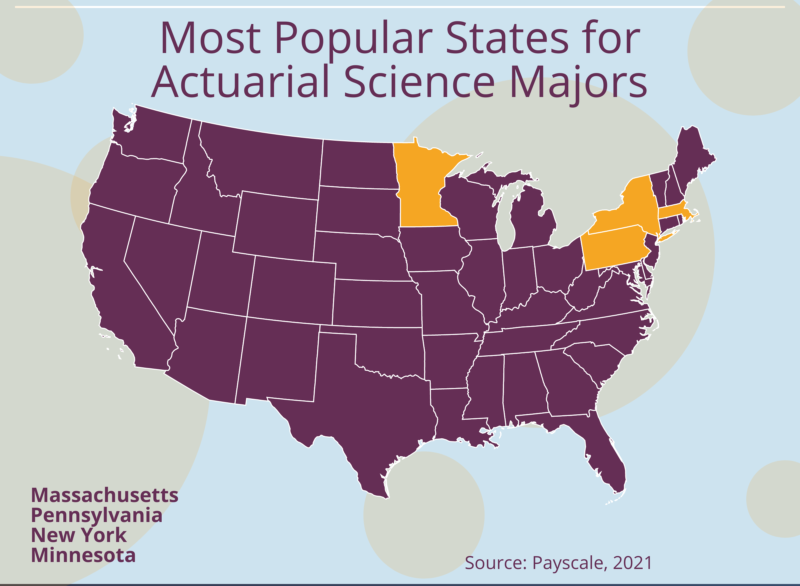

Choosing a College for Actuarial Science

If you want to become an actuary, you’ll need to start with the right education. You have a lot of great options, partly because you don’t necessarily need to attend one of the best actuarial science schools. That’s because you may not need an actuarial science degree at all. Of course, actuarial science is a good major for future actuaries, and if you know that you want to attend one of the best actuarial schools, then that decision can absolutely help you in your career. Finding the top actuarial science colleges certainly is one of the more straightforward pathways.

That said, you can also start your career by majoring in statistics, math, or a similar analytical field. They key is to sharpen your analytical skills and learn how to apply those skills to a business setting.

So, whether you take the general route or the specific route, what should you look for in the best actuarial science programs? What sets the best actuarial science schools and the top actuarial science programs apart from the rest?

You can start by googling the top actuarial science colleges and best colleges for statistics. You’ll find lots of choices with great math and business programs that way. From there, you can narrow your search.

As you search the top actuarial colleges, your first priority should be finding an accredited school. Accredited colleges and universities meet particular standards for education. When you attend an accredited school, whether or not it’s one of the top schools for actuarial science, you’ll know that you’re getting a worthwhile education.

The best actuarial schools will cover the right courses. Again, you don’t necessarily need one of the top actuarial science programs to get these courses. But whether you attend one of the top actuarial science schools or earn a related degree, you should look for some specific class offerings.

First, you’ll definitely need some analytics and statistics classes. The top actuarial science schools should also offer advanced math courses like calculus and linear algebra. You’ll need microeconomics and macroeconomics courses. (If you don’t attend one of the top actuary colleges, having a math major and a business minor can help you here.)

Believe it or not, you’ll also need some writing and communication classes. The top undergraduate actuarial science programs require these courses. That’s because leaders at the top actuary colleges know that actuaries do more than predict events; They also have to explain their findings in an accessible way. You can be excellent at math, and you can attend one of the best actuarial science undergraduate programs available, but if you can’t communicate with people who don’t have your skills, then you won’t be nearly as effective as you could be.

Next, as you look at the top actuarial colleges and the top undergraduate actuarial science programs, don’t forget about your particular needs and requirements. Even if you attend one of the top schools for actuarial science, it won’t matter if that school doesn’t fit your needs.

What are you looking for in your college experience? Again, your initial search for the top colleges for actuarial science will help you get started, but that search is just the tip of the iceberg. Consider your priorities. Those priorities might include:

- Cost, financial aid, and scholarship opportunities

- Class size

- Location

- Religious affiliation

- Online learning opportunities

Not all the top colleges for actuarial science will meet your needs, so don’t skip this step when you start your college search.

Types of Actuarial Science Degrees

While you can become an actuary with a degree in math or statistics, you might have decided to pursue an actuarial science degree rather than something more general. But what is an actuarial science degree? A bachelor’s degree in actuarial science will cover the things you need to know for an entry-level actuarial position. Courses will cover advanced math, statistics, communication, and economics. They may also cover topics related to the insurance field, specifically.

With a bachelor’s degree in actuarial science, you may be able to pursue a concentration in a specific area. A lot of people associate actuaries with life insurance, but many other insurance companies hire actuaries. You may be able to concentrate in health, risk management, corporate insurance, or another area of specialization.

Finally, you can also pursue a degree in actuarial science online, if that’s what works best for you. Online actuarial science degrees cover the same coursework and are often taught by the same teachers as their on-campus counterparts.

There are many reasons to look into actuarial science online degrees. For example, if you’re an adult learner with responsibilities outside of school, then looking into actuarial science degrees online can help you find flexible course options.

While some online actuarial science degrees may require one or two visits to campus, other actuarial science online degrees are 100% online and require no campus time. Some programs may have set login times. However, when you look into actuarial science degrees, online options do often include self-paced courses, which means that you could finish your degree on your own time. In any case, an online degree can help you get your education if an on-campus degree just isn’t feasible right now.

A degree in actuarial science, online or otherwise, can help you pursue the career that aligns with your goals.

Becoming an Actuary

Now, you got the “what is an actuary” answer with the definition of actuary listed above. But now you probably have some other questions. For instance, what does an actuary do every day? What goes into the actuary job description? After all, you can’t really know the definition of an actuary if you can’t name what an actuary does from one day to the next.

For that matter, you might be asking how to become an actuary yourself. How long does it take to become an actuary? You’ll get the answers to those questions in this section.

You can start with the first question: What exactly is in the actuary job description? A lot of people are confused by what an actuary does. Now, what actuaries do can vary because actuaries work on different projects. It’s part of the description of an actuary. Once they finish one project, they move on to the next one, and they often work on a few projects at once.

But what do actuaries do on an average day? First, an actuary arrives at the workplace, which is usually a specific division of an insurance company. Careers as an actuary can vary based on which division an actuary works in. What does an actuary do from there? At this point, the actuary job description involves doing some math to answer questions from the insurance company. Those questions might include:

- What is the life expectancy of this particular demographic?

- How likely are motorcycle accidents among this age group?

- What are the chance of a major flood in our area this year?

When people ask “what is an actuary?” one possible answer is that an actuary is someone who answers questions. The definition of actuary work involves a lot of problem-solving. What does an actuary do to answer those questions? They apply financial theory, math, and statistics to find the answers.

A description of an actuary job might also mention reports and meetings. Once an actuary figures out the likelihood of an event, they put together a report on that information. Then, they’ll either pass the report along to their bosses, or they’ll present their findings in a meeting. That’s why careers as an actuary involve good communication skills.

So, now that you’ve gone even deeper into the “what is an actuary” question, you might be asking yourself: “How do I become an actuary?” The first step to an actuaries career is to get the right training and education. Again, you can start an actuaries career without majoring in actuarial science. But you will want to attend a school that will prepare you for your career, and there are several great careers for actuarial science majors.

To become a certified professional actuary, you’ll have to take a series of actuarial exams. At this point, you might have several questions again. For example, a lot of people want to know:

- What are actuarial exams?

- What is the actuarial exams pass rate? And do I need to be worried about actuarial exam pass rates?

- What is the cost of actuarial exams? Can I afford these actuarial exam costs?

- How many actuarial exams are there? Is there a list of actuarial exams?

- How do I become an actuary if I should fail an exam? Is actuarial science a good career for me even if I fail an exam?

You’ll find the answers in the next several paragraphs.

First, what are actuarial exams? Actuarial exams come from two organizations: Casualty Actuarial Society (CAS) and the Society of Actuaries (SOA). These exams test a person’s ability to perform actuarial tasks effectively.

Second, what is the actuarial exams pass rate? Actuarial exam pass rates can vary depending on the exam. However, it’s important to note that these exams are extremely difficult. The initial exams have a pass rate of only 30–40%, so the “what is an actuary exam” question is just the tip of the iceberg. The good news, however, is that you can retake actuarial exams if you fail them on your first try. So if this information is making you ask “Is actuarial science a good career after all?” don’t get discouraged.

Third, what is the cost of actuarial exams? Since there are so many actuarial exams, a lot of future actuaries worry about the actuarial exam costs. They are expensive exams, ranging from $250 for the earliest exams to well over $1000 for the most advanced exams. Again, don’t get discouraged, because you may not have to pay for all of these exams out of pocket.

You can start your actuary career as a trainee, which is the most common pathway for actuaries. You’ll probably be expected to take the first couple of exams before you graduate from college, but your employer may pay for the rest of your exams as you move through the ranks. Many employers pay for study materials, too.

Fourth, how many actuarial exams are there? Actuaries are expected to pass a minimum of seven exams. The list of actuarial exams can look overwhelming, but remember that you don’t have to take all of these exams at once.

Finally, is an actuary a good career for you even if you fail your first exam? It can be! A lot of actuaries fail their exams on the first try. So if you’ve gone from “What is an actuary exam?” to “Is an actuary a good career?” after learning the answer, try to take things one step at a time.

Now you’ve seen how to become an actuary. So, with all of the exams and training, how long does it take to become an actuary? How many years does it take to become an actuary if you have to take some exams more than once? The training and exams can take between three and five years.

Careers in Actuarial Science

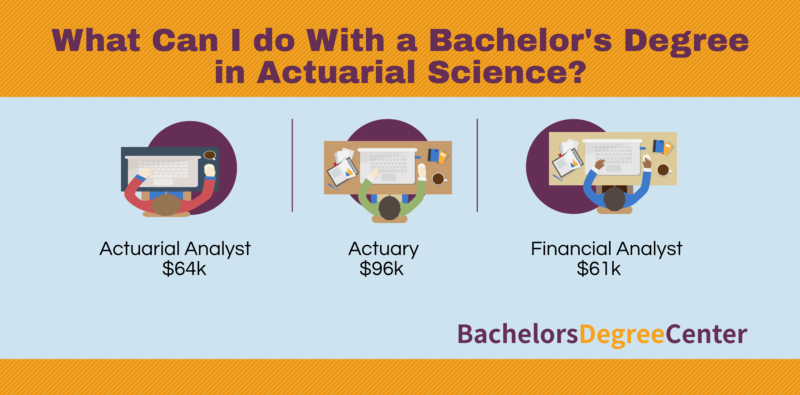

“What can I do with a degree in actuarial science if I decide not to take the exams?” some students want to know. “What jobs can I get with an actuarial science degree?” Well, it turns out that an actuary degree can lead to a lot of opportunities. Whether you look into actuarial science jobs or jobs related to actuarial science, the skills you’ll learn in your degree program will make you extremely valuable in the workforce.

So, what can you do with an actuarial science degree? More specifically, what jobs can you get with an actuarial science degree? The short answer is “a lot.” Even better, most actuarial science degree jobs pay very well. Since you’re thinking about actuarial science degree jobs, start by looking at jobs for actuaries. Again, entry-level actuary jobs are usually trainee positions. Other jobs for actuaries include actuary assistant options. Some entry-level actuary jobs can lead to these positions.

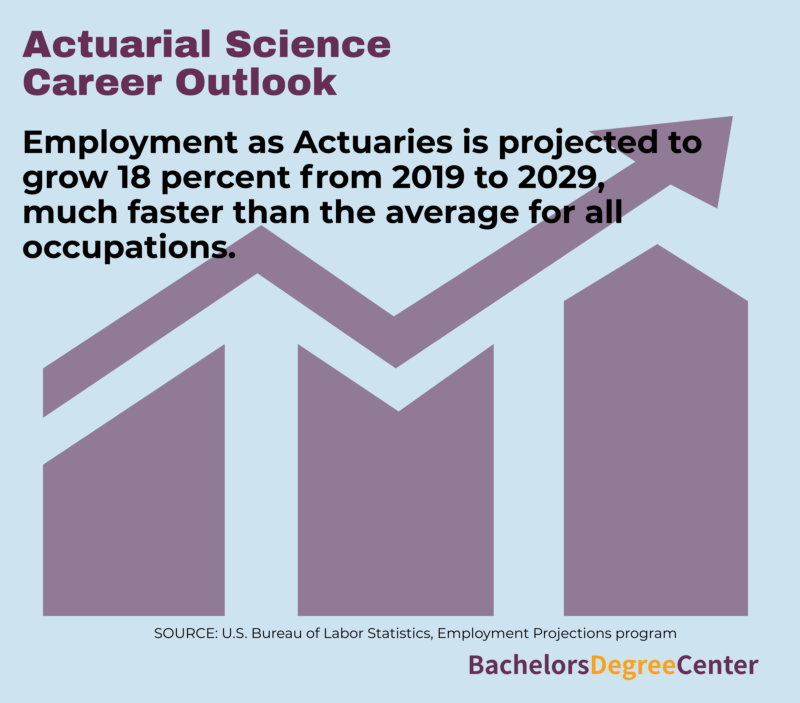

In spite of the challenging exams, there’s a reason why entry-level jobs in actuarial science are so appealing. The future of actuarial science looks bright, and the employment outlook for actuaries is high. How high is the employment outlook for actuaries, exactly? Well, jobs for actuaries are expected to grow by 18% over the next several years. The actuary jobs outlook is much higher than average. (For reference, a growth rate of 9% is considered good, and the actuary jobs outlook is twice that number.)

However, if you decide not to pursue any actuary science jobs, there are still plenty of possible jobs for actuarial science graduates. Although actuarial science jobs abound, some graduates do choose not to go down that route. Those who don’t want actuarial science jobs can look for jobs related to actuarial science instead. Some possible jobs for actuarial science graduates include:

- Banking and investing

- Management

- Research analysis

- Cost estimation

- Etc.

So if jobs in actuarial science don’t turn out to be for you, then actuarial degree jobs don’t necessarily have to mean becoming an actuary. If you’re asking “What can I do with an actuarial science degree?” the answer is more than you think. There may be a great job outlook for actuaries and lots of job opportunities in actuarial science, but a lot of related fields are promising, too.

Salary for an Actuary

Next, you’ll probably have a lot of questions about salary. Most people want to know how much money they can expect to make with their degree. That said, most people can’t expect to make the same amount as an actuary. So, what is the average starting salary for an actuary? And what about the salary for an actuary who has been in the field for a while?

Start by taking a look at the actuarial science starting salary. Obviously, the entry level actuary salary is going to be lower than the average salary of actuaries who have more experience. That said, actuary starting salaries are still fairly high. On average, actuary starting salaries are about $72,700 per year.

Next, take a look at the average salary of actuaries who have reached the mid-point of their careers. The average salary for an actuary at this point is more than $108,000.

Of course, “What is the salary of an actuary?” isn’t always a straightforward question, since a lot of factors can come into play. The average salary of actuaries in big cities, for example, may be a lot bigger than the average salary for an actuary in a suburban area. Even so, actuaries can expect to earn comfortable salaries at all stages of their careers.

Professional Organizations

Finally, as you consider your degree and career options, take a look at professional organizations. The main organizations in the US are the Society of Actuaries and Casualty Actuarial Society. However, there are several others, many of which are related to specific divisions and concerns. Joining a professional society can help you in your career, especially with networking. Professional organizations provide an easy way to connect to like-minded people. Furthermore, you might find some job opportunities by joining a professional organization or two. Some organizations have job boards and similar resources for their members.

Related Rankings:

25 Best Bachelor’s in Actuarial Science

15 Best Online Bachelor’s in Actuarial Science

10 Fastest Online Bachelor’s in Actuarial Science